Exploring Subscription Models

for Foreign Transaction Fees

Generative Research

Our client, in partnership with a major Australian bank, wanted to explore customer interest in a subscription based plan for charging international transaction fees on credit cards.

They sought to understand customer preferences

to aid the development of a viable model.

I led the 8-week project, managing recruitment, conducting user interviews, running a large-scale survey, synthesising findings, and delivering the final presentation. I also acted as the main point of contact for the client throughout.

Project Background

The bank wanted to explore if a subscription-based model for charging international transaction fees would appeal to customers, and how cardholder engagement might affect its adoption.

Research Goals

Test Interest

Evaluate interest in subscription models for charging international transaction fees.

Test 3 Concepts

Test desirability and adoption.

Understand Engagement

Explore how cardholder engagement relates to international transaction fees.

Research Process

Qualitative +

Quantitative

Methods

24 User Interviews

Uncovered deep insights into user experiences and motivations, and helped refine the draft subscription models

1000 Survey Respondents

Provided broader, data-driven patterns to validate and expand on findings

Kicking off the Project

Stakeholder interviews were held to understand business goals and key assumptions, informing the recruitment process and the moderator guide.

Existing Quantitative Data

The client provided quantitative data, segmenting customers into four groups based on domestic, overseas, and international spending.

These segments formed an initial customer framework that played a key role in our recruitment process.

Flat-rate Model

A single, fixed fee is charged per month regardless of usage.

Tier-based Model

3 predefined fee tiers, with each tier offering different levels of features per month.

Concepts to Test

User Interview Preparation

Recruitment

Current credit card holders from Australian banks.

Mix of bank and non-bank customers.

Representation across pre-identified customer segments.

Recruitment conducted via the Askable platform, with progress tracked in Excel.

24 participants selected (6 from each segment).

Hand-picked participants represented all segments and a variety of banks.

Moderator Guide

The moderator guide focused on understanding financial habits, international transaction fee sensitivity, and evaluating the desirability and adoption of subscription-based fee models.

Background: Understand use of financial products.

Domestic Spending: Explore local spending and credit card use.

Overseas Travel: Investigate spending habits and international transaction fee sensitivity when abroad.

Online Shopping: Investigate spending habits and international transaction fee sensitivity when shopping online.

Concept Testing: Gather feedback on preferred concepts and models.

Ongoing synthesis was carried out using

affinity mapping in Miro.

Conducting User Interviews

During Interviews:

A research assistant recorded notes in an Excel

spreadsheet, and I summarised key insights after each

remote session, providing stakeholders with weekly updates.

Refining the Models

Following user interviews, I provided concise feedback on each concept, highlighting key findings, benefits, limitations, user desires, and suggestions for improvement. The models were then revised for testing as part of the survey.

👍

Adopter

Rewards-Driven Spender

Credit card use is motivated by rewards like frequent flyer points and cash back. This is the biggest driver when signing up to a new credit card.

Uses credit cards for 70% of spending.

Financially savvy, they research to get the best value.

International transaction fees are just one factor; they also seek additional perks to assess the overall return on investment.

Credit card is preferred method of spending when traveling overseas and shopping online.

Per-added Model

Monthly fee calculated on base fee + additional features chosen by the user.

Forming User Personas

While analysing user needs, attitudes, behaviors, pain points, and motivations, two distinct personas began to emerge. These personas helped the client tailor the product to its target adopters.

👎🏻

Non-Adopter

Wary-of-Debt Spender

Primarily uses debit cards to avoid debt and interest.

Rewards aren't a priority; prefer spending money they have.

Rarely uses credit cards, except for large purchases or low cash flow.

Not financially savvy, prefers familiar options, and unlikely to adopt a new credit card due to international transaction fees.

Travels less overseas and shops online less, preferring travel cards or cash.

Survey Goals

Identify potential adopters of subscription-based FX fee models.

Assess attractiveness of different fee models.

Screener questions captured credit card users at various engagement levels, focusing on those who incur interest, as the bank aimed to target this group.

The survey flow focused on concept feedback with multiple choice and scaled rating questions, informed by interview insights.

The survey was conducted in SurveyMonkey,

and data was analysed alongside interview findings

to gain deeper insights.

Deliverables

What we delivered

✓ Weekly Progress Updates shared with the client.

✓ 24 x Interview Summary Documents with key insights, quotes, and virtual recordings.

✓ 1 x Model Feedback Report with initial findings, benefits, limitations, desires, and suggestions.

✓ 1 x In-depth Report covering research goals, approach, concept insights, and user preferences.

✓ 1 x Formal Final Presentation delivered to stakeholders and the team.

Key Findings

Snapshot of Key Insights

International transaction fees alone have little impact on adoption, as likely adopters are generally indifferent.

Rewards are the primary motivator for signing up for a new credit card and driving spending.

Overseas travelers accept international transaction fees as a standard part of travel expenses.

Online shoppers focus on total cost, including exchange rates & postage, rather than international transaction fees.

The biggest pain point is lack of transparency; participants want clear information on international transaction fees.

Additional rewards and benefits are key factors in attracting participants to sign up for a new credit card.

Flexible, month-to-month subscription options are highly appealing for aligning with varied travel habits.

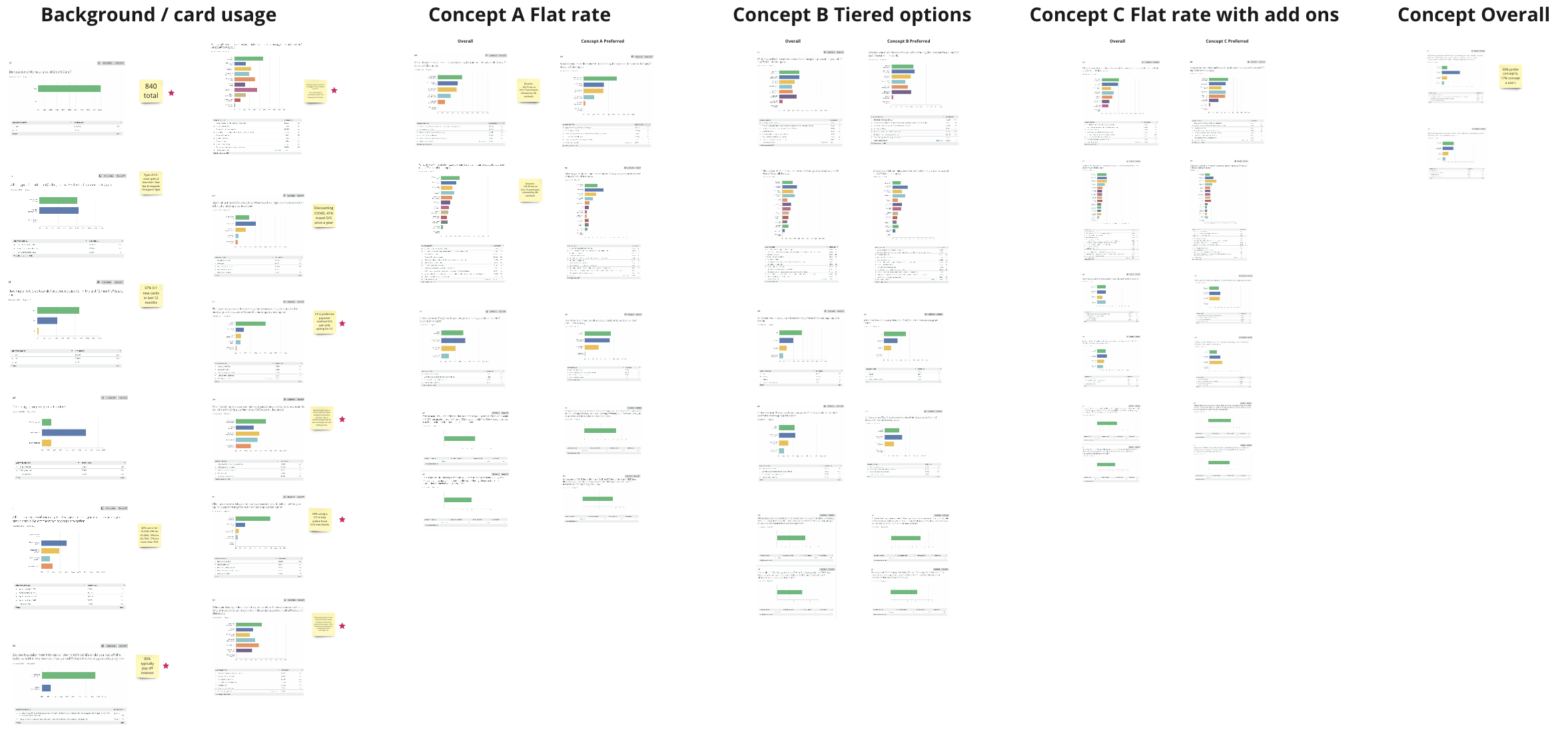

Model Preferences

💬

Qualitative Findings (24 Interviews)

Initial Concept Testing

13/24 preferred the per-added module driven by 5% cashback, especially for frequent travelers.

User case: mostly overseas travel

Tier-based model was least favored, with 0/24 participants choosing it, due to the cap on FX-free transactions.

📊

Survey Findings (1000 respondents)

Revised Concept Testing

58% preferred the tier-based model, with the free tier option being a key driver. 53% preferred the free tier option.

Flat rate and pre-added module were each chosen by 17% of respondents.

We proposed that the introduction of a free tier in the survey models skewed preferences towards tiered pricing, while the interviews highlighted the importance of cashback for frequent travelers.

Recommendations to Target

'Rewards-Driven Spenders'

💳

Rewards Based

International Transaction Fees should be a ‘feature’,

not the main selling point.

🏆

Sign-Up Bonuses

Offer rewards such as frequent flyer points to attract engaged users and stand out in the market.

💰

Rewards For Use

Include perks like frequent flyer points and cashback on essentials to appeal to value-driven users.

🌍

Overseas Travel

Offer unlimited transactions & flexible month-month options

to suit travel.

👌

Clear Fees

Make International Transaction Fees Clear: Lack of transparency is

the biggest pain point.

Reflection

The insights empowered the client to refine the product based on user preferences, driving improved adoption.

What went well

Strong client engagement facilitated model refinement.

Research goals were met on time.

Assumptions were validated through clear patterns.

Challenges

High survey disqualification rate required screener adjustments.

Data analysis delayed by errors and slang in free-text responses.